Fed rate hike

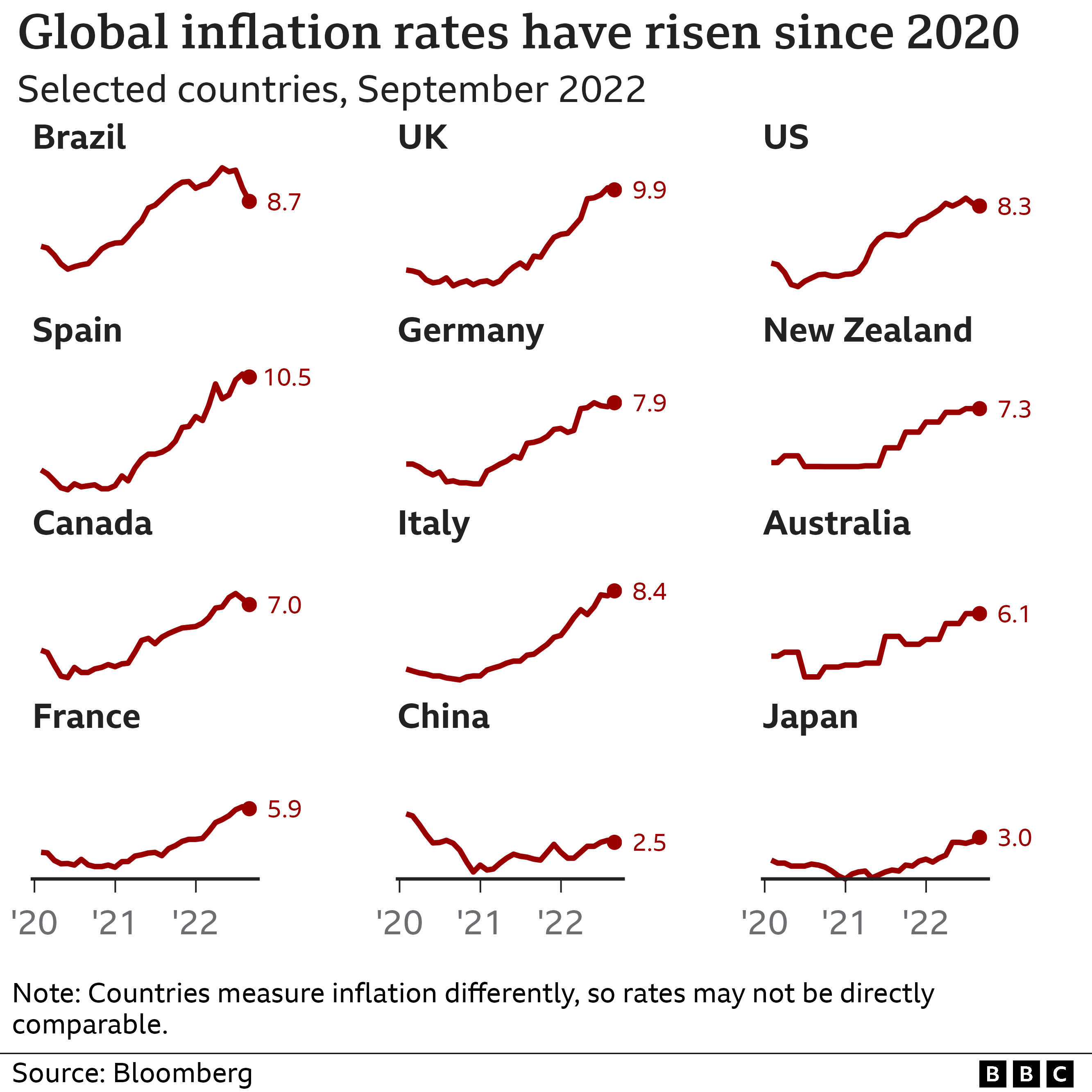

Web While its still a hefty number thats hovering near 40-year highs its the lowest year-over-year rate since January. Web This view appears to be the conventional wisdom.

Us Federal Reserve With The Third Interest Rate Hike This Year

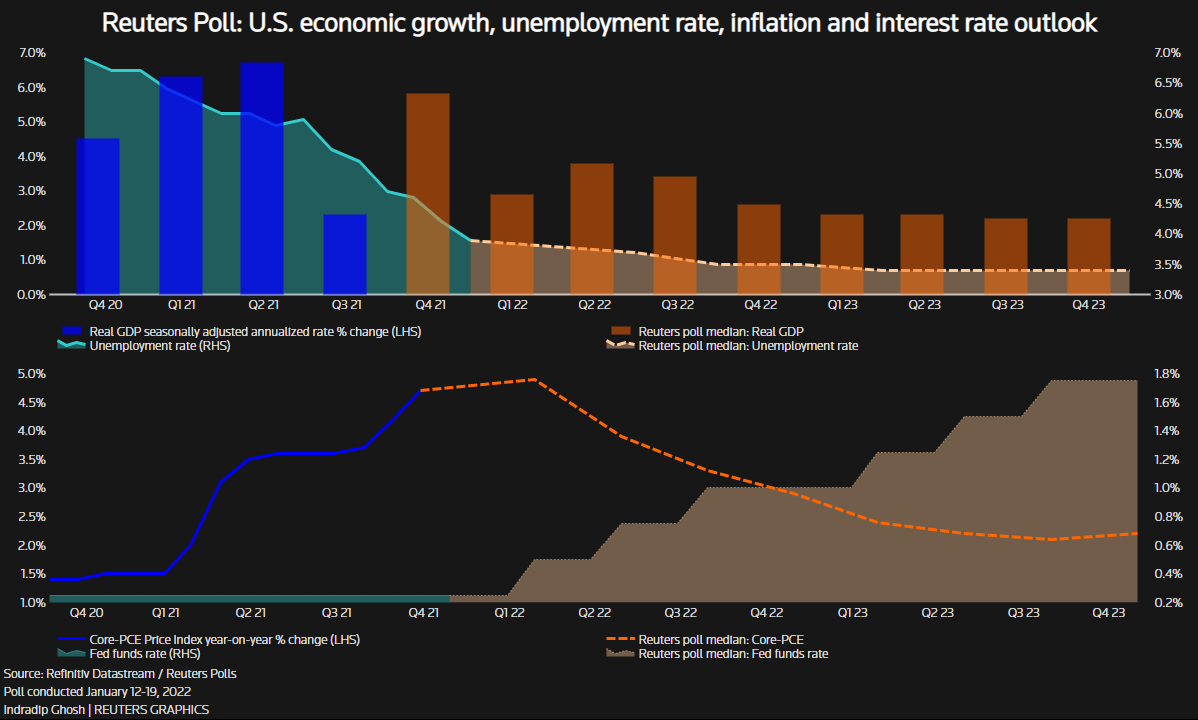

With three remaining meetings on the calendar for 2022.

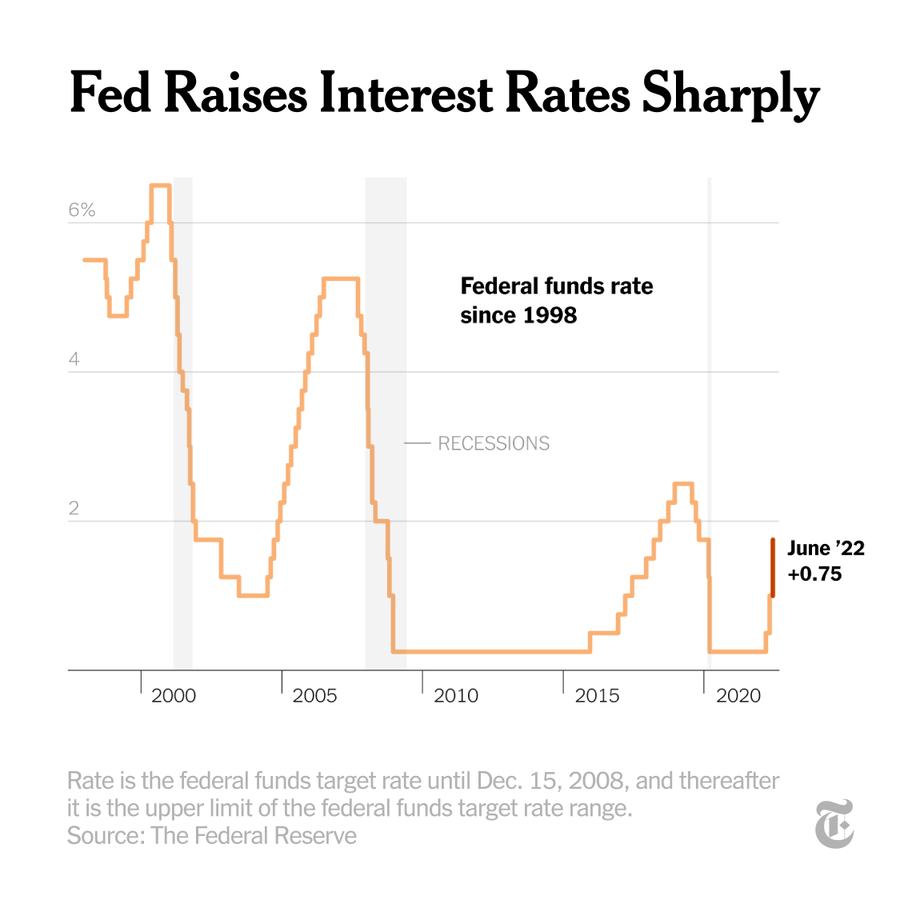

. Web 1 day agoThe Fed expects interest rates to rise to between 51 and 54 next year near the level they were in 2006. Its easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022. Web The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008.

Bank of America Securities predicts the Fed will raise interest rates to a range of 5 to 525 before pausing. Web The tight monetary policy from the Fed has already included three outsized 75 basis point rate hikes a 50 basis point rate hike and a 25 basis point rate hike all in a bid to tame inflation. Central bank is widely expected to lift the federal funds rate by 50 basis points at the conclusion of its two-day meeting on Wednesday a slightly smaller increase than the 75-basis.

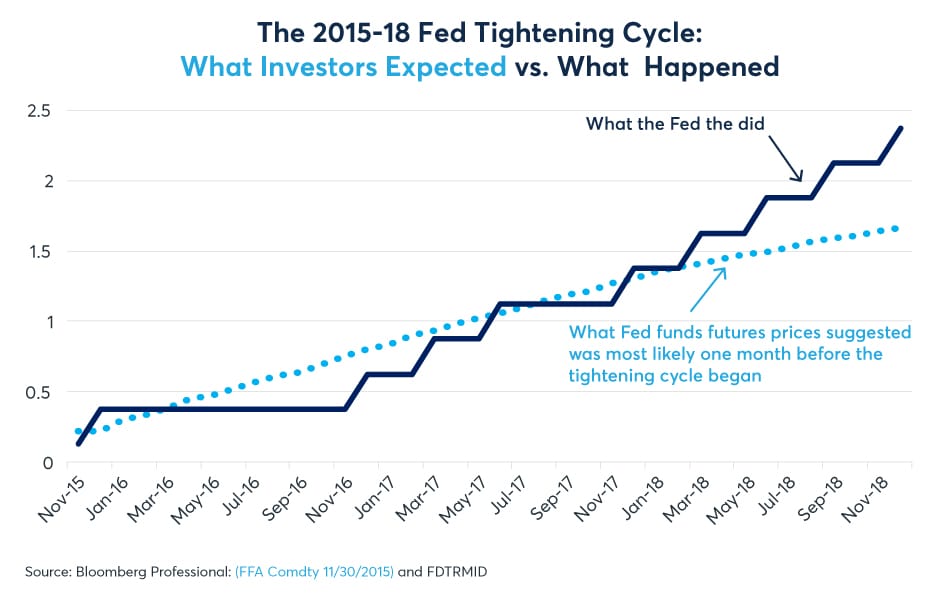

After the 50 bps rate hike in. For context the Fed raised rates to 237 during the peak. Web What rate hikes cost you.

Web Fed announces another interest rate hike of 05. Web 075 to 100. Rate hikes are associated with the peak of the economic cycle and are meant to slow down inflation to apply the brakes in an overheating economy.

Higher rates lower inflation by making it more expensive to borrow decreasing. Amid signs that price growth in the US. Web 2 days agoThe Fed has to portray itself as tough on inflation even as it pushes through a smaller rate hike Published Tue Dec 13 2022 216 PM EST Updated Tue Dec 13 2022 1001 PM EST Patti Domm inpatti.

Web The Feds rate hikes have had a clear impact on the housing market with surging mortgage rates helping to put a dent into home sales. Web Today the Fed raised rates 075 as broadly expected in a consensus decision backing away from a 1 rise that was an outside possibility. Officials did hike rates on April.

The central bank has been bedeviled by stubbornly high. The Fed was also. Web Investors are expecting the Fed will raise the high end of its target range to at least 375 by the end of the year up from 1 today.

Economy is rapidly cooling the Federal Reserve announced Wednesday it was slowing the pace of its rate. So far the Feds five hikes in 2022 have increased rates by a combined 3 percentage points which means consumers are now paying an extra 300 in interest on every. Web What Is a Fed Rate Hike.

Still Wall Street is growing more confident that the Fed. Web The FOMCs December rate increase is the latest in a series of hikes beginning early this year. Web The Federal Reserve has announced that it will raise interest rates another 05 percent to 45 percent marking the seventh increase of 2022.

Web Besides during the early 1990s the Fed mainly adjusted rates at Federal Open Market Committee FOMC meetings a practice that is in rhythm with todays Fed. During his post-meeting conference Fed Chair Jerome Powell signaled the central bank. Now economists are guessing the Feds interest rate express will come to a rest in spring 2023 but not before the benchmark rate now in a range of 375 to 40 hits a peak north of 5.

Those estimates show. The increase comes following the latest consumer price index report showing that inflation. Web The Federal Reserve made history on Wednesday approving a third consecutive 75-basis-point hike in an aggressive move to tackle the white-hot inflation that has been plaguing the US economy.

As for the future course of policy officials now expect a higher peak funds rate. Web For context inflations increase in September was 82. The higher rate will immediately increase borrowing costs for consumers and.

Web A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. This type of rate hike occurs when the US. The Fed has also initiated a reduction of its near 9 trillion balance sheet as it rolls off 95 billion per month in a combination of Treasury and.

Central bank raises the interest rate that banks charge each other. The Fed has remained staunch in raising interest rates with Fed Chairman Jerome Powell consistently saying that the Fed will ease rising. Web 1 day agoDespite the risk the Fed is on track to hike rates past 5 percent next year according to projections released at the end of the central banks two-day policy meeting.

Web The rate hike is the sixth consecutive one this year for the Fed a cycle not seen since the inflation-fighting days of the early 1980s. Web 1 day agoThe US. It will boost the target federal funds rate to 425 to 450 a 50-basis-point jump from November and a 425-basis-point increase from the beginning of 2022.

More specifically this refers to the rate at which banks. This will however be the smallest of the last four rate hikes showing promise that the increases will slow soon.

Why A Federal Reserve Interest Rate Hike Could Help To Lower Inflation As Usa

Federal Reserve Approves Its Third Rate Hike Of The Year

10 Year Yields Highest Since 2011 Before Expected Fed Rate Hike

Raising Interest Rates In Uncharted Territory

Fed Rate Hike Us Interest Rates Hit 14 Year High In Inflation Battle Bbc News

Federal Reserve Hikes Rates By Half Point To Tame Inflation

Fed Rate Hikes Expectations And Reality Cme Group

Fed Cuts Us Interest Rates To Zero As Part Of Sweeping Crisis Measures Financial Times

Fed To Raise Rates Three Times This Year To Tame Unruly Inflation Reuters Poll Reuters

S Ds On Expected Interest Rates Hike We Must Avoid Mistakes Of The Past And Protect The Most Vulnerable Europeans Socialists Democrats

Federal Reserve Approves First Interest Rate Hike In More Than Three Years Sees Six More Ahead

Powell Signals Smaller Rate Hikes Ahead On Path To Higher Peak Bnn Bloomberg

Treasury Two Year Yields Head For 4 Ahead Of Big Fed Rate Hike

:max_bytes(150000):strip_icc()/fredgraph-a800d4ef93634168b10b23290a1a57d1.png)

Federal Reserve Interest Rate Hikes In Investors Crosshairs

Savers Have Yet To Benefit From This Fed Rate Hike Cycle Marketwatch

The Market Expects Another Three Quarter Point Interest Hike In November Then What Mish Talk Global Economic Trend Analysis

Federal Reserve May Go Easy After 75 Basis Point Rate Hike Next Week Business Standard News