40+ federal tax mortgage interest deduction

Also you can deduct the points. Web For more on the home mortgage interest deduction check out this recent Tax Foundation piece on the topic as well as the blog archive.

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Web Standard deduction rates are as follows.

. 12950 for tax year 2022. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Your mortgage lender should send. Homeowners who bought houses before.

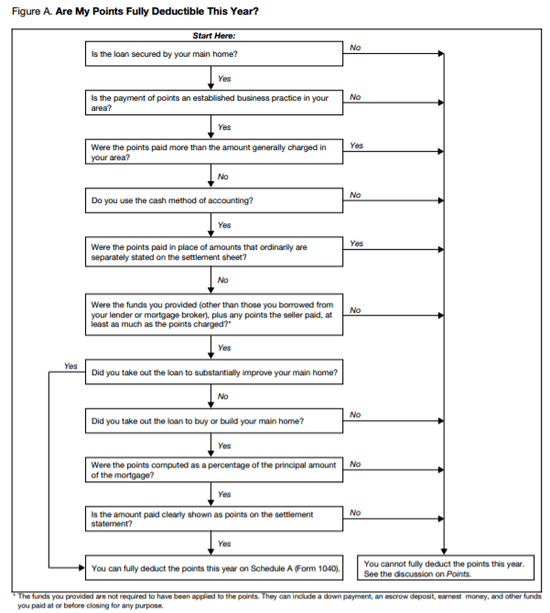

Web Bankrates Mortgage Interest Deduction Calculator can give you an idea of the math youll need to do. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Companies are required by law to send W-2 forms to. Web The IRS places several limits on the amount of interest that you can deduct each year. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

Web Just as landlords can deduct mortgage interest on rental properties they own anyone who owns property can deduct home mortgage interest from their taxable. Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form. Married filing jointly or qualifying widow.

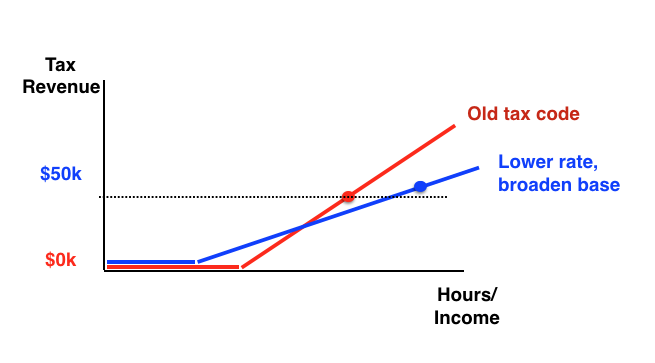

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web For 2021 tax returns the government has raised the standard deduction to. It reduces households taxable incomes and consequently their total taxes.

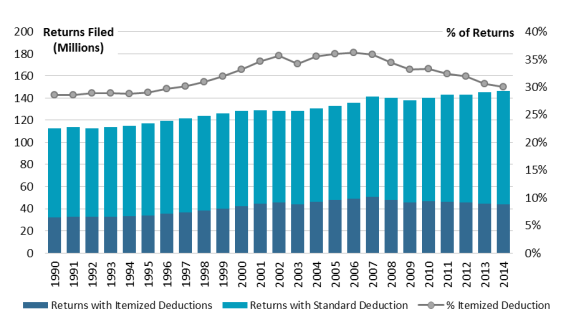

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Most homeowners can deduct all of their mortgage interest.

Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Stay informed on the tax. The type of deduction you claim on your federal income tax.

Single or married filing separately 12550. Single taxpayers and married taxpayers who file separate returns.

Mortgage Interest Deduction Changes In 2018

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Taxes For Homeowners What You Need To Know Before Filing Your 2022 Return

A Model Form For Mortgage Statements From The Consumer Financial Protection Bureau Statement Template Mortgage Mortgage Payoff

U S Senator Elizabeth Warren I M Thrilled That The 1 1 Million Members Of The National Association Of Realtors Have Endorsed My Bank On Students Student Loan Refinancing Bill They Recognize That Student

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Economic Housing Presentation To Temecula Noon Rotary 2 29 12

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Mortgage Interest Deduction How It Works In 2022 Wsj

The Federal Tax System For The 2017 Tax Year Everycrsreport Com

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

I Pulled Historical Data From 1973 2019 Calculated What Four Identical Scenarios Would Cost In Each Year And Then Adjusted Everything To Be Reflected In 2021 Dollars 4 Images Sources In Comments R Dataisbeautiful

How Much Is U S Aid To Ukraine Costing You Econlib

Bfkubxdrctak M

Tax Graph Seeking Alpha